Time Value of Money

June 26, 2011 1 Comment

Wikipedia describes it as “the value of money figuring in a given amount of interest earned over a given amount of time. To investopedia, it is “the idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity.” And to lottery winners who discover they can only get roughly half of what they won if they want the money up front, it’s a bunch of crap! But make no mistake about it; the time value of money concept is one the most fundamental in all of finance- personal, corporate, or investment. It serves as the basis for everything from compounding interest to the valuation of firms and is critical to understanding, and ultimately making, any long-term investment decision. But far from overly complicated, it is too often misunderstood or, at least, taken for granted. If you don’t believe me, ask your friends how many of them stash away $20 or $30 each month knowing the power harnessed inside this simple concept. Or ask yourself why in the world you loaned your friend $50 with the expectation of receiving exactly $50 at a later, perhaps much later, date. Or, going back to our earlier example, sit down with one of so many lottery winners who are angry when they learn that they’re really not millionaires. Not right away, at least.

From a business perspective, using a method known as Discounted Cash Flows (or DCF), you can take advantage of the rules embedded in the time value of money to figure out the real worth of almost anything. “Real”, of course, is a vague, illusive even, term. What I mean to say is “your” real value, taking into account your perceived risk and any other opportunities (opportunity cost) that you may have. Plainly put, a dollar today is worth more than a dollar tomorrow. So the bank is willing to pay you more tomorrow for allowing it to use your money today. Just like the state, who agreed to pay you a million dollars in 20 annual installments of $50,000 if you won the lottery, is only going to pay you a fraction of that (maybe even less than half) if you want it up front. Why? Because the state loses the ability to invest the balance of that money ($1M minus 50k paid to you in year 1 minus 50k paid to you in year 2 to you, etc.) over the next 20 years. In essence, they punish you, the lottery winner, for this. And the price tag (the difference between $1M and what the state will give you up front) is calculated using whatever rate they feel (or implicitly claim) they could have earned on that money had you let them hold onto it.

My friend, Kevin, who I’ll talk about more in later posts, brought up an even greater (and in some ways more disturbing) comparison: the housing prices, especially here in California. If home buyers at the peak of the housing boom had taken the time to apply this rule, he pointed out, we may not be in the situation we find ourselves today. A simple exercise in which you value a house at the present value of both the inflows (possible rental values) and the terminal value (point in time where you believe the inflows will slow to a steady, constant growth state) bears this out. (Note: The formula includes too many unknown variables–including the growth rate in the rental prices, the discount rate, and number of years for which you are forecasting–to be unequivocally accurate, but it’s still a productive exercise.)

Below are what I hope are simple explanations and real world examples of the applications of the Time Value of Money.

Simple Interest

Not used very often, this is the simplest of the TVM (Time Value of Money) formulas. Using r as the annual rate of interest (the rate the lender–e.g. bank–is willing to pay you for holding onto your money) and PV as the amount you initially put away, you simply calculate the annual interest earned (PV * r) and multiply it by the number of years, t, before the money is returned.

Example: $100 for 5 years @ 5% FV = PV + (PV * r * t) = $100 + ($100 * .05 * 5) = $125

Compound Interest

Simple interest is not fair to the person lending the money. Why? Because it ignores the fact that the lender has the option to pull her money out and reinvest the higher amount. As a result and following this line of reasoning, the interest earned is greater in each subsequent year. In our same scenario, for example, $100 would earn $5 in the first year. If withdrawn then reinvested, the new amount, $105, would earn $5.25. Another year later, the balance would grow to $110.25, which, again if taken out and reinvested, would earn $5.51. And so on. Again using PV as the initial amount invested, r as the annual rate of interest, and t as the total number of years invested, the formula for calculating the Future Value, FV, is:

Example: $100 for 5 years @ 5%, compounded annually FV = PV * (1+r)t = $100 * (1 + .05)5 = $127.63

Compound Interest with faster compound rate

Obviously lenders aren’t restricted to loaning their money in one-year terms or increments. Because of this, most borrowers, including banks and companies who raise money, compound the interest more frequently. Again, the reasoning behind this is that the lender could theoretically take his money out and reinvest the larger amount right away. Most loans, therefore, are compounded quarterly, monthly, even daily. And this is what makes compounded interest so powerful and why every child, in my opinion, should be taught this important lesson early in school.

Tweaking the original formula to account for the additional compound periods is easy. The interest rate, r, is divided by the number of times per year the interest is compounded; while the number of years, t, is multiplied by this same number. If our original example was compounded monthly, for example, $100 would grow to $100.42 after one month. In the second month, it would grow to $100.84; $101.26 in the third; and so on. With PV as the initial amount invested, r as the annual rate of interest, t as the total number of years, and n as the number of times the interest is compounded per year, the Future Value, FV, is:

Example: $100 for 5 years @ 5%, compounded monthly FV = PV * (1+r/n)t*n = $100 * [1+(.05/12)]5*12 = $100 * (1 + 0.004167)60 = $128.34

Discounting or Present Value

This rule, of course, also works in reverse. The foundation remains the same, though. A dollar today is worth more than a dollar tomorrow. The present value, then, of $100 received some time in the future, is less than $100. And the longer one has to wait for that $100, the lower the present value. This law is vital when measuring the value of any investment, where the main objective is always to gain a profit by paying less than the value of all future expected cash flows. And while forecasting the cash flows is difficult enough, discounting those cash flows is equally challenging, and just as important.

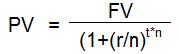

To solve for the present value, we use good old Algebra to flip our earlier formula. Now with FV as the cash inflow expected in the future, r as the annual rate of interest (typically the rate the lender feels he could earn elsewhere), t as the total number of years before the cash flow is realized, and n as the number of times the interest is compounded per year, the Present Value, PV, is:

Example: $100 discounted 5 years @ 5%, compounded monthly PV = FV/[1+(r/n)]t*n = $100/[1+(.05/12)]5*12 = $100 / (1 + 0.004167)60 = $77.92

Working with Annuities

Because cash flows, especially when looking at those of a business or similar investment, are seldom static or fixed over time, using the regular present value method to discount each expected payout individually is appropriate. But when the cash streams are known and constant–like with lottery winnings, for example–treating them as an annuity is much easier and quicker.

Example: $100 per year for 5 years, discounted @ 5%

PV = Pmt * [1-(1+r)-n)]/r * (1+r)

= $100 * [(1 + 1.05)-5]/.05 * (1.05)

= $454.60

.... or

Example: $100 per year forever, discounted @ 5% (Perpetuity)

PV = Pmt / r

= $100 / .05

= $2,000.00

.... and

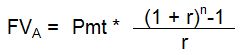

Example: $100 per year for 5 years, compounded @ 5%

FVA = Pmt * [(1+r)n)-1]/r

= $100 * [(1 + .05)5-1]/.05

= $552.56

Using Microsoft Excel

Once you get used to it, the formulas outlined above are fairly easy to use and apply. But like with most financial equations and formulas, Excel makes it even simpler. Using one of two functions, PV() or FV(), one can quickly figure out the present or future value of any payment or stream of payments (annuity).

Future Value =FV(rate,nper,pmt,[pv],[type]) where rate = periodic rate (if compounding monthly, this is the annual rate/12) nper = total periods (if compounded monthly, this is the total num. of yrs * 12) pmt = for an annuity, the amt. of each pmt. (must be entered as negative number) [pv] = optional; starting total [type] = optional; timing of payment (1 if paid @ beg. of per.; 2 if @ end) Present Value =PV(rate,nper,pmt,[fv],[type]) where rate = periodic rate (if compounding monthly, this is the annual rate/12) nper = total periods (if compounded monthly, this is the total num. of yrs * 12) pmt = for an annuity, the amt. of each pmt. (must be entered as negative number) [fv] = optional; ending total [type] = optional; timing of payment (1 if paid @ beg. of per.; 2 if @ end)

Other (Advanced) Time Value Formulas

There are other, more advanced, Time Value of Money (TVM) formulas and concepts. The most useful involve the growth of an annuity or perpetuity. For example, instead of a stream of a constant sum like $100 over time, what if the amount of the payout or cash flow grew by a certain rate each period? Tools that help with the evaluation of these kinds of decisions can be especially valuable. If for example, you are planning to buy a building, which you then plan to lease, it is unlikely the lease payments that you charge your tenants will remain the same for several years into the future. Instead, it is likely you’d work into both the model and the eventual contract periodic escalations in the payments. These, and other advanced concepts, will be covered in a later post/article. For now, I hope you have a better understanding of the Time Value of Money, and all of the power contained within it.

My mind is spinning…but I love it Bobby! I, of all people–believe me, need this little lesson. Just ask my husband! 🙂 j